Blog

Project Portfolio Management (PPM): A Complete Guide for Strategy, Governance, and Execution

Most organizations don’t fail because teams can’t deliver projects. They fail because they run too many projects at once, fund the wrong work, or stretch resources too thin. Project Portfolio Management (PPM) solves that. It gives leadership a structured way to choose the right initiatives, set priorities, and steer the portfolio as conditions change.

This article is a practical guide to PPM. It covers the definition, core components, lifecycle methods, common challenges, and what to look for in tools that support portfolio-level decision-making.

1. What Is Project Portfolio Management (PPM)?

Project Portfolio Management (PPM) is the practice of managing multiple projects and programs as a coordinated portfolio rather than as independent initiatives. It typically sits at enterprise or executive level to guide how initiatives are selected, prioritized, and governed across the organization.

Instead of focusing on delivery at the project level, PPM focuses on selection, prioritization, governance, and oversight across all initiatives. It helps organizations decide where to invest, how to allocate limited resources, and how to manage cumulative risk as conditions change.

PPM applies across a wide range of initiatives, including:

- business and IT transformation programs

- product development portfolios

- capital and infrastructure projects

- regulatory and compliance initiatives

- enterprise change programs

At its core, PPM provides a structured way to connect strategy to execution. It ensures that projects advance with clarity on priorities, constraints, and expected outcomes – not just momentum.

2. Why Project Portfolio Management Is Different from Project Management

Project Portfolio Management operates at a different level than project management. While project teams focus on delivering approved work, PPM governs which work should exist, how it is prioritized, and whether it should continue as conditions change.

In some organizations, related projects are grouped into programs to coordinate delivery across shared objectives. Program management helps align those related projects, but portfolio management governs which programs and projects are prioritized in the first place and how they compete for shared capacity.

This distinction matters because strong execution at project level does not prevent failure at portfolio level. When multiple initiatives compete for the same limited resources, efficiency within individual projects cannot resolve portfolio-level trade-offs or misaligned investment decisions.

Project Management: Delivering Defined Scope

Project management focuses on planning and delivering a specific initiative within agreed constraints. Project managers are responsible for schedules, budgets, scope, risks, and day-to-day coordination.

Once a project is approved, project management concentrates on execution. It does not decide whether the project should start, how it ranks against other initiatives, or whether it should stop when priorities shift.

Project Portfolio Management: Governing Investment and Priority

Responsibility for PPM typically lies with senior leadership, a portfolio board, or an enterprise-level function such as an Enterprise PMO or Portfolio Management Office.

PPM defines:

- which initiatives are approved

- how projects are prioritized against each other

- how limited capacity and funding are allocated

- when initiatives should pause, change direction, or stop

Rather than managing delivery details, PPM establishes decision frameworks and governance structures that guide all execution.

The Role of the PMO

In many organizations, the PMO supports both project execution and portfolio oversight. However, a PMO does not automatically equate to PPM.

A delivery-focused PMO typically standardizes methods, reporting, and tools. A portfolio-oriented PMO supports PPM by preparing data, facilitating governance, and enabling portfolio-level visibility – but final prioritization and investment decisions remain with leadership.

3. Core Components of Project Portfolio Management

In practice, effective PPM rests on several interdependent disciplines. Weakness in any one of them reduces the value of the whole.

Portfolio Governance

Governance defines how portfolio decisions are made, reviewed, and escalated. It clarifies who decides, what evidence is required, and when decisions must occur.

Without governance, prioritization becomes informal and inconsistent. Projects continue by default rather than by choice.

Financial and Investment Oversight

PPM provides visibility into total investment across the portfolio. It connects budgets, forecasts, and actuals at portfolio level, not just per project.

This perspective helps organizations manage exposure, assess affordability, and adjust funding before overruns harden.

Resource and Capacity Management

PPM treats resources as shared constraints rather than project-specific assignments. It compares demand against realistic capacity and highlights overload early.

This approach allows organizations to sequence work, delay lower-priority initiatives, and protect critical projects from hidden competition.

Risk and Dependency Management

Risks and dependencies often cut across projects. PPM makes these relationships visible and actionable.

Instead of documenting risks in isolation, portfolio management assesses how risks accumulate and interact – and how they affect portfolio viability.

Performance and Outcome Monitoring

PPM shifts reporting away from activity tracking toward decision readiness, milestones, and outcome indicators. It focuses attention on whether projects remain viable, not just busy.

For readers looking for a deeper exploration of Project Portfolio Management methods, objectives, and tools, this topic is examined in more detail in a dedicated article.

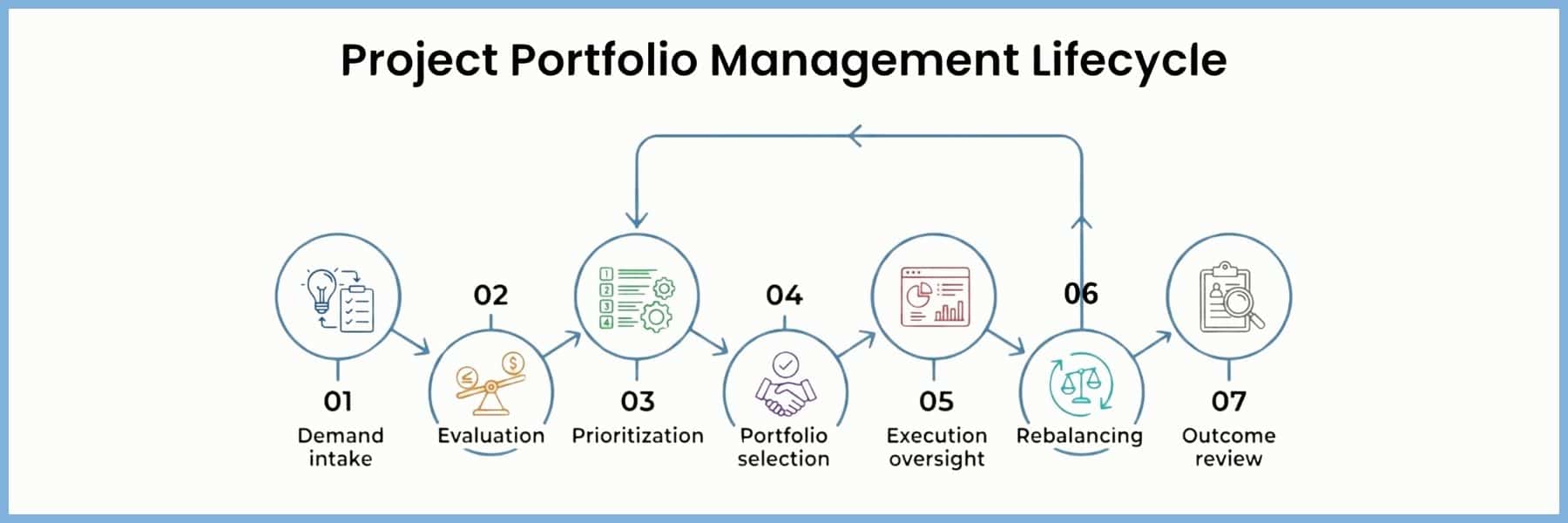

5. The Project Portfolio Management Lifecycle

Project Portfolio Management follows a continuous lifecycle that governs how initiatives enter the portfolio, how they are evaluated, and how decisions evolve over time. Unlike project lifecycles, which often progress linearly, the portfolio lifecycle remains active throughout execution.

Step 1: Demand Intake and Initiative Capture

The lifecycle begins by capturing demand in a structured and consistent way. Organizations collect project ideas, business initiatives, regulatory requirements, and change requests through a common intake mechanism. At this stage, the objective is visibility rather than approval, ensuring that initiatives enter the portfolio on equal terms rather than through informal commitments.

Step 2: Evaluation and Comparative Assessment

Once initiatives are visible, PPM applies shared evaluation criteria such as strategic alignment, expected value, risk exposure, cost, and resource demand. This step enables initiatives to be compared against one another rather than assessed in isolation, shifting discussion away from advocacy and toward evidence-based trade-offs.

Step 3: Prioritization and Portfolio Selection

Evaluation leads to prioritization. Leaders rank initiatives against each other and test against realistic capacity and funding constraints. This step makes trade-offs explicit and determines which initiatives move forward, which are deferred, and which do not proceed.

Step 4: Portfolio Authorization and Commitment

Approved initiatives enter the active portfolio through formal authorization. Funding, resources, and decision authority are explicitly committed, marking the transition from intent to obligation. This clarity reduces ambiguity around ownership and accountability before execution begins.

Step 5: Execution Oversight and Portfolio Monitoring

As initiatives progress, PPM maintains oversight at portfolio level rather than tracking task-level activity. It monitors progress, emerging risks, dependencies, and cumulative resource consumption across initiatives, allowing systemic issues to surface early.

Step 6: Rebalancing and Adaptive Decision-Making

Because conditions change, portfolio decisions must remain flexible. PPM enables organizations to revisit priorities, adjust sequencing, reallocate resources, or pause initiatives as new information emerges, rather than waiting for formal project failure.

Step 7: Outcome Review and Value Realization

The lifecycle closes by assessing outcomes once initiatives reach key milestones or completion. Rather than focusing only on delivery metrics, organizations review whether expected benefits were realized and whether assumptions held true, using these insights to strengthen future portfolio decisions.

6. Governance and Decision-Making at Portfolio Level

At portfolio level, governance does not sit on top of execution as a reporting layer. It operates as a decision discipline that shapes how initiatives are approved, reviewed, and adjusted across the portfolio. When governance is unclear, prioritization erodes and portfolios drift as projects continue by default.

Effective PPM governance establishes a small number of non-negotiables that guide portfolio decisions:

- Clear decision authority

Governance defines who can approve, defer, reprioritize, or stop initiatives. This clarity prevents decisions from stalling in committees or being made implicitly through inaction. - Explicit decision timing

Portfolio decisions occur at defined points in the lifecycle, not only at project start. Timely intervention prevents unresolved risks, funding assumptions, and resource conflicts from spreading across initiatives. - Consistent decision criteria

Teams evaluate initiatives using shared criteria, such as strategic alignment, risk exposure, capacity impact, and affordability. This consistency shifts discussion away from advocacy and toward trade-offs. - Cross-functional accountability

Portfolio decisions require alignment across business, technical, financial, and operational perspectives. Governance creates a shared decision space where responsibility is collective rather than fragmented by function. - Portfolio-level oversight

Governance operates above individual projects. It balances ambition against capacity, manages cumulative risk, and ensures that priorities remain coherent across the organization.

Together, these elements allow organizations to intervene early, adjust direction deliberately, and maintain control as portfolios evolve – rather than reacting once friction becomes visible.

7. Portfolio and Resource Management in Practice

Organizations rarely struggle because they lack ideas. They struggle because they commit to more work than their people, budgets, and systems can realistically support. Portfolio and resource management exist to confront that gap directly.

In PPM, resource management is not about assigning individuals to tasks. It is about aligning ambition with capacity at portfolio level and making constraints visible before they disrupt execution.

In practice, portfolio and resource management depend on a few recurring principles:

Portfolio-level prioritization

PPM evaluates initiatives relative to one another, not in isolation. This perspective helps organizations balance short-term delivery, long-term investment, and risk across initiatives at different stages of maturity.

Capacity-aware planning

Rather than assuming resources are infinitely flexible, PPM plans against realistic capacity. It highlights where demand exceeds availability and forces trade-offs before overcommitment becomes systemic.

Management of shared constraints

Specialized roles, decision bodies, systems, and facilities often act as bottlenecks across projects. Portfolio-level visibility exposes these shared constraints early, allowing sequencing and prioritization to adapt before delays cascade.

Dynamic alignment between portfolio and execution

As projects progress, assumptions change. PPM connects execution realities back to portfolio decisions, ensuring that shifts in risk, scope, or timelines inform prioritization rather than remaining isolated project updates.

Protection of critical initiatives

By making resource contention explicit, PPM helps organizations shield high-priority initiatives from hidden competition, reducing disruption caused by unplanned reallocations and late-stage firefighting.

When portfolio and resource management work together, organizations move away from constant overload. Decisions become deliberate, priorities remain credible, and execution stabilizes across the portfolio rather than oscillating between crises.

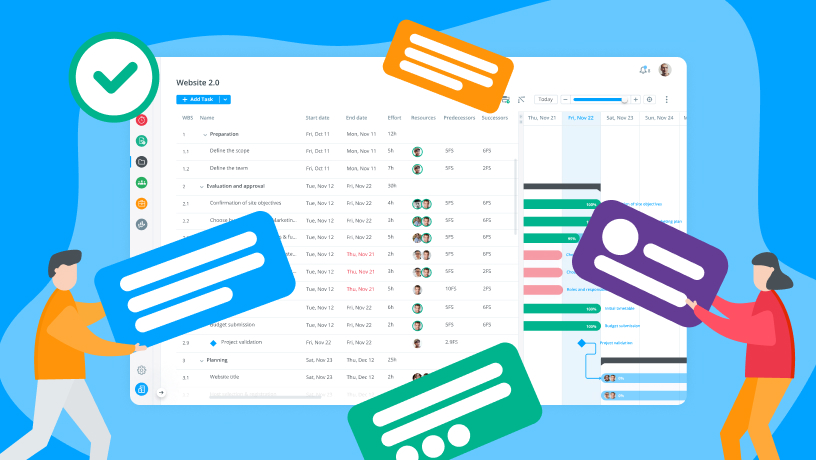

8. Project Portfolio Management Software

Project Portfolio Management software supports decisions that cut across multiple projects, time horizons, and organizational boundaries. Unlike project-level tools, its primary role is not task coordination, but portfolio-level visibility, consistency, and control.

Many organizations attempt to manage portfolios using generic project or work management tools. While these tools often work well at team level, they struggle as portfolios grow. Reporting fragments, prioritization becomes manual, and portfolio decisions rely increasingly on spreadsheets and offline consolidation. As a result, visibility lags behind reality.

In PPM environments, software adds value less through automation and more through decision support. Effective platforms provide a consistent view of initiatives, allowing leaders to compare work, assess trade-offs, and intervene before issues propagate across the portfolio.

At a minimum, PPM software should support the following capabilities:

- Portfolio-level visibility: Consolidated views across initiatives, covering status, risk, cost, and resource demand.

- Consistent prioritization and governance: Shared evaluation criteria, approval workflows, and traceable decisions that remain consistent over time.

- Financial and capacity oversight: The ability to assess affordability and resource feasibility across the portfolio, not just within individual projects.

- Traceability over time: Clear links between assumptions, decisions, changes, and outcomes, enabling organizations to understand how priorities evolved.

- Adaptability at scale: Flexibility to adjust structures, criteria, and reporting as portfolios and operating conditions change.

In practice, organizations often require solutions designed to support portfolio-level decision-making, governance, and prioritization at scale, particularly as portfolios mature and complexity increases.

9. Measuring Success in Project Portfolio Management

In Project Portfolio Management, success is not something teams measure once projects are complete. It shows up continuously in how decisions are made, revisited, and acted on.

When PPM is working, portfolio decisions happen deliberately. Leaders choose what moves forward, what waits, and what stops – and those choices reflect current capacity and priorities, not historical commitments.

When PPM is not working, portfolios feel busy but unstable. Projects progress by momentum, priorities shift informally, and trade-offs surface only when delivery teams reach breaking point.

In successful PPM environments, a few patterns consistently emerge:

- Decisions are visible: Portfolio choices have clear ownership and rationale. Teams understand why initiatives were approved or deferred, even when they disagree.

- Constraints are acknowledged early: Capacity limits, funding pressure, and shared bottlenecks shape decisions before execution begins, not after conflicts emerge.

- Change triggers review: When assumptions shift – scope expands, risks increase, timelines move – portfolio priorities are revisited rather than absorbed silently at project level.

- Outcomes stabilize over time: While individual projects still vary, the portfolio becomes more predictable. Fewer surprises escalate into crises, and recovery requires less firefighting.

By contrast, adding more metrics rarely fixes weak portfolio control. Dashboards can describe overload, but they cannot resolve it. What distinguishes mature PPM is not the volume of reporting, but the discipline to act on what the portfolio reveals.

10. Conclusion

Project Portfolio Management becomes essential when organizations operate at scale. As portfolios grow, decisions compound and constraints interact, making execution alone insufficient to keep work aligned.

PPM governs choice. It determines what work proceeds, how priorities shift, and when commitments must change as evidence improves. In environments defined by ongoing change and finite resources, this discipline provides clarity when certainty is not available.

FAQs – Project Portfolio Management (PPM)

What is Project Portfolio Management (PPM)?

Project Portfolio Management (PPM) is the practice of managing multiple projects and programs as a coordinated portfolio rather than as independent initiatives. It helps organizations decide which initiatives to pursue, how to prioritize them, and how to allocate limited resources across competing work.

How is PPM different from project management?

Project management focuses on delivering a specific initiative within agreed constraints such as scope, time, and budget. PPM operates at a higher level, governing which projects should exist, how they are prioritized against each other, and whether they should continue as conditions change.

Who is responsible for Project Portfolio Management in an organization?

Responsibility for PPM typically sits at enterprise or executive level. This may include senior leadership, a portfolio board, or an enterprise-level PMO. While project teams manage execution, PPM defines priorities, decision frameworks, and investment trade-offs across the organization.

Why do organizations need Project Portfolio Management?

Organizations need PPM when managing projects individually no longer provides sufficient control. As portfolios grow, projects begin to compete for shared resources, funding, and decision capacity. PPM makes these trade-offs explicit and helps prevent overload, misaligned investment, and unmanaged risk.

What types of initiatives does PPM apply to?

PPM applies across a wide range of initiatives, including business and IT transformation programs, product development portfolios, capital and infrastructure projects, regulatory and compliance initiatives, and enterprise change programs.

What are the core components of Project Portfolio Management?

Core components of PPM typically include portfolio governance, financial and investment oversight, resource and capacity management, risk and dependency management, and performance and outcome monitoring. These disciplines work together to support portfolio-level decision-making.

What is the Project Portfolio Management lifecycle?

The PPM lifecycle governs how initiatives enter the portfolio, how they are evaluated and prioritized, and how decisions evolve over time. It typically includes demand intake, evaluation, prioritization, authorization, execution oversight, rebalancing, and outcome review.

How does PPM handle changing priorities?

PPM treats portfolios as dynamic rather than static. As assumptions change, risks emerge, or capacity shifts, portfolio decisions are revisited. This allows organizations to adjust sequencing, reallocate resources, or pause initiatives before issues escalate.

What does success look like in Project Portfolio Management?

Successful PPM environments show clear, timely decision-making. Priorities remain explicit, constraints surface early, and portfolio outcomes become more predictable over time. Rather than relying on more metrics, mature PPM focuses on acting on the information the portfolio reveals.

Why are generic project management tools often insufficient for PPM?

Generic project tools focus on task coordination and team-level execution. As portfolios grow, these tools struggle to provide consistent portfolio-level visibility, prioritization, and governance. PPM environments require systems that support decision-making across multiple initiatives and time horizons.

Task Management

Task Management

Customization

Customization