Blog

PPM Software Selection Guide

Introduction:

Selecting the right Project Portfolio Management software (PPM software) is a critical decision for any project-centric organization. With a constantly evolving marketplace and a wide range of options—from basic project management tools to comprehensive enterprise-level solutions—choosing the best fit can be overwhelming. This guide is designed to help you navigate the complexities of the PPM software selection process. By following a structured approach, from identifying your business pains to researching vendors and conducting formal evaluations, you can ensure that your organization selects the most effective solution to meet its unique needs and drive long-term success.

For a more in-depth visual explanation, check out our accompanying YouTube video.

Step 1: Business Pain

Clearly identify current needs and requirements

Probably one of the most common mistakes buyers of enterprise software make is to take a reactive approach to the evaluation and selection of a new system. Based on partial requirements and/or possibly partial short-term challenges they face, it is not uncommon for companies to launch a full blown evaluation project for a new system without fully understanding their needs and the long term impact of a newly acquired system.

This reality is even more true for project-centric organizations that are looking for a portfolio and project management tool to assist them in their everyday tasks. Navigating the PPM marketplace can be very complex with a whole host of options ranging from basic project management tools delivered on-demand to full blown project portfolio management systems aimed at meeting the enterprise needs of the project management office (PMO).

Considering this, it is critical that organizations do their homework in assessing their own requirements before falling into an unguided PPM evaluation trap that can frankly leave them confused or led down the path of analysis paralysis with a lot of time and money wasted leading to poor results.

To avoid an unsuccessful evaluation project, as a first step, PPM buyers need to clearly identify the relevant business pains, establish stakeholder buy-in and build a plan for the evaluation process.

To get started, here are some questions you need to ask yourself:

The key to successfully launching a PPM evaluation project is to be methodical and comprehensive when it comes to taking stock of your current situation. Clarity of your own needs will start you off on the right foot in finding the best project and portfolio management solution to best suit your needs.

Step 2: Strategic Research

Leverage the best online and offline sources of information.

When launching your software evaluation project in the hopes of finding that perfect solution to meet your needs, you will quickly discover that “Googling” keywords to help you find your software of choice will lead you down many paths. Although more than ever the internet has shortened the process of unearthing options, it can also complicate your research process by providing unfiltered information that can leave you confused and discouraged.

The project portfolio management (PPM) software marketplace is continuously changing. As a new entrant looking for a solution it will take time and the right strategy to understand the history, business models and capabilities of the possible options that will solve your current business pains.

As much as understanding your business pain is important, it is as critical that you build a research strategy to tackle the PPM marketplace. Your research strategy needs to be effectively planned and executed in a manner that is in line with your ultimate goals in acquiring a new PPM system.

To continue your successful software evaluation journey, PPM buyers need to develop an effective research plan that will help them identify a long list of 5-10 potential vendors that may meet their needs.

To help you in your research strategy, here are some the questions you need to ask yourself:

Developing a long list of 5-10 potential suppliers to meet your unique needs requires a well thought out and planned research strategy. Following a road map will point you in the right direction in evaluating the best project portfolio management solutions aligned with your business.

Step 3: Formal Evaluation

Develop a formal approach to analyze and share vendor information.

At the end of the research process in your evaluation for a new solution, the real work begins with efficiently organizing all the information gathered and effectively building a formal process of mapping your prioritized needs to the available options in the marketplace. Depending on the depth of your evaluation, building an evaluation matrix in the form of a Request for Information (RFI) or Request for Proposal (RFP) document can deliver the transparency required to guide you toward the best fit solution.

The PPM marketplace is constantly evolving and demands a formal process to clearly assess the various products and the ability for vendors to deliver on their promises. Organizations need to establish a software evaluation and selection process for the project portfolio management (PPM) software marketplace that considers both functional capabilities and vendor viability.

Formalizing the software evaluation and selection process should not be taken lightly. It is this process that will ensure the right choice is made and can save your organization time, money and grief that can occur when going down the wrong path.

To ensure the successful evaluation and selection of a PPM solution, buyers need to establish a formalized software evaluation process that will allow them to determine and assess their shortlist of 2-3 vendors that will ultimately meet their needs.

When developing a formalized software evaluation process, here are some the questions you need to ask yourself:

Evaluating your short list of 2-3 potential suppliers demands a well-crafted plan of attack. Building the right processes and employing the right tools will provide the required transparency to the evaluation team in objectively reviewing project portfolio management solutions best suited to their needs.

Step 4: Vendor Selection

Validate your analysis with vendor interactions.

Once a short list of vendors has been determined and all the necessary data has been gathered, the final step in the evaluation process of a new system is to dig deeper with the final candidates to validate your analysis and finalize the procurement process to move forward in your decision. As organizations get closer to their final decision, the procurement strategy comes to the forefront and stakeholder buy-in must be validated.

There are several strategies that facilitate the decision-making process of selecting the best fit project and portfolio management (PPM) solution to meet your needs. From developing scripted demos to distributing Requests for Quotations (RFQs) to short-listing vendors; these final strategies will provide you with the necessary information to make the best-informed decision possible.

Incorporating key pricing, trial and demo details into a formalized software evaluation and selection process will not only provide complete information for analysis but will also allow you and your organization to engage with your potential supplier. This interaction will also ensure that there is a cultural fit with your software provider.

The final selection of a PPM package requires a methodical approach from the exploratory stage until final acquisition. As a final phase, the best fit solution will come on top based on how well a vendor has demonstrated their ability to meet the functional, cultural, and financial needs of your organisation.

When finalizing the selection of your new PPM software, here are some the questions you need to ask yourself:

In your final stage, selecting your vendor and product of choice should be a final validation of your analysis. At this stage it’s the vendor’s business to lose if they are not able to effectively demonstrate on their product and business information you have captured and delivered at a fair market value.

Conclusion: Choosing the Right PPM Software for Your Organization

Selecting the best PPM software is a critical decision that can significantly impact the efficiency and success of your project portfolio. By following a structured approach—starting with identifying your business needs, conducting thorough research, evaluating vendors, and making informed choices—you set your organization up for long-term success.

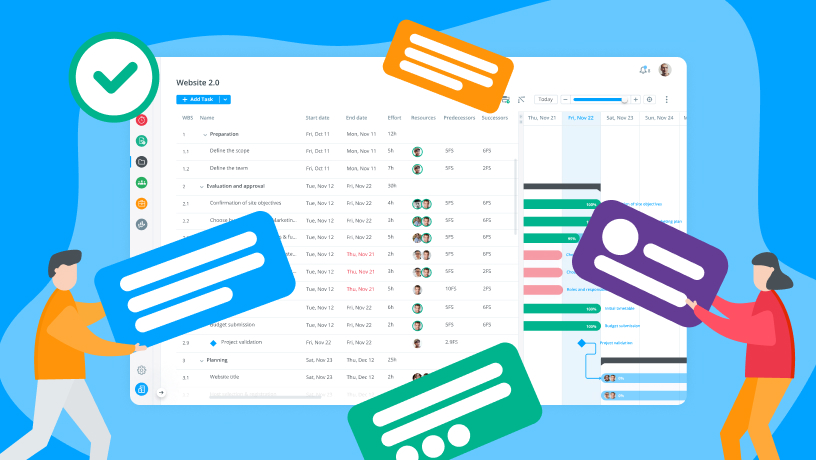

As you navigate the PPM landscape, consider solutions that not only meet your immediate needs but also offer scalability and flexibility for future growth. One such solution is Cerri Project, which provides comprehensive tools to support your project and portfolio management. From advanced resource allocation to real-time collaboration and decision-making features, Cerri Project PPM Software enables organizations to streamline workflows and drive higher ROI from their projects. To learn more about how Cerri Project’s PPM capabilities can support your organization’s success, visit our PPM features page.

Task Management

Task Management

Customization

Customization