Blog

Capital Project Management in Manufacturing: Tools and KPIs That Matter

Introduction: The High Stakes of Capital Projects in Manufacturing

Capital project management in manufacturing involves overseeing large-scale, long-term investments – such as new facilities, equipment upgrades, or industrial automation rollouts – that are critical to strategic growth. These capital-intensive initiatives often span multiple years, and as a result, they require tight coordination between engineering, operations, and finance teams.

Still, despite their importance, a large percentage of capital projects still miss the mark. According to McKinsey, “large capital projects across industries take 20% longer to complete than planned and run up to 80% over budget.” (1) In manufacturing, such delays and cost overruns can significantly erode return on investment and delay competitiveness.

That’s why effective capital project management in manufacturing isn’t just about staying on track; rather, it’s about choosing the right tools, tracking KPIs, and ensuring governance from day one.

1. Capital Project Management in Manufacturing: What It Means and Why It Matters

Capital project management (CPM) refers to the planning, execution, and oversight of long-term, asset-heavy projects. Specifically, these projects require significant upfront investment and deliver value over time. In a manufacturing context, these projects can include initiatives such as:

- Building or expanding production plants

- Installing or upgrading machinery and robotics

- Rolling out industrial IT infrastructure (e.g. MES, ERP)

- Energy efficiency retrofits or sustainability upgrades

Unlike operational or continuous improvement initiatives, capital projects typically involve:

- High financial stakes and long approval cycles

- Cross-functional collaboration between engineering, operations, finance, and external contractors

- Strategic alignment with long-term business goals

- Tight integration with procurement, compliance, and risk frameworks

PMI highlights that “organizations with mature capital project practices are more likely to meet original goals and deliver projects on time and within budget.” (2) That maturity is built on discipline, defined metrics, and governance. In particular, portfolio-level oversight is key for success.

In short: capital projects aren’t just bigger, they’re structurally more complex, and they demand a more rigorous, data-driven approach than typical projects.

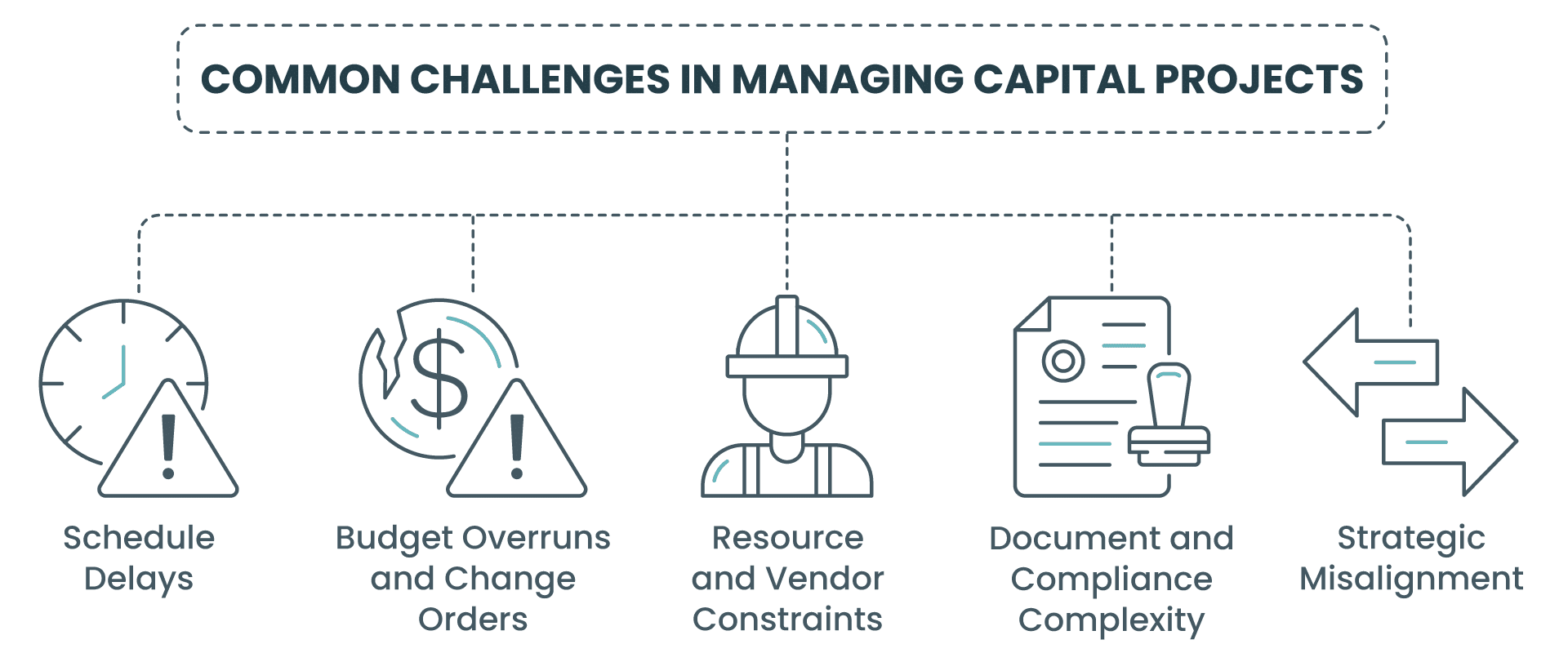

2. Common Challenges in Managing Capital Projects

Capital projects in manufacturing are complex by nature and that complexity introduces risk. Even with experienced teams and detailed planning, manufacturers face recurring challenges that can derail timelines, inflate costs, and compromise project outcomes.

Here are some of the most common obstacles:

1. Schedule Delays

Large capital projects often involve site preparation, specialized equipment installation, and contractor coordination; all of which can lead to bottlenecks. Delays in one phase cascade into others, especially when dependencies are tightly linked.

According to PMI, “poor schedule management is one of the top three reasons capital projects fail to meet objectives.” (3)

2. Budget Overruns and Change Orders

Cost forecasting in long-term projects is inherently difficult. Furthermore, scope creep, unexpected technical complications, or supplier pricing changes can all lead to unplanned expenses and frequent change requests; each one adding risk.

3. Resource and Vendor Constraints

Capital projects often rely on external contractors, consultants, or specialized technicians. In addition, limited availability or contractual misalignment can disrupt schedules and reduce accountability if not well managed.

4. Document and Compliance Complexity

Large-scale projects involve permits, contracts, engineering specs, safety certifications, and inspection reports. Without centralized control, teams may lose track of critical documentation, exposing the company to legal or compliance risks – especially in sectors like food, pharma, and energy.

5. Strategic Misalignment

Perhaps most critically, capital projects can lose relevance midstream if they’re not tied to evolving business goals. A project may be delivered on time and on budget but still fail to generate expected ROI if strategic priorities have shifted.

Strong capital project management requires not only technical execution but tight integration of planning, monitoring, and governance tools. In the next section, we’ll explore which capabilities matter most and how software can help.

3. Tools That Enable Effective Capital Project Management

Successfully managing capital projects in manufacturing requires more than good intentions and spreadsheets. Consequently, these high-stakes, high-value initiatives demand structured tools that provide visibility, enforce accountability, and support decision-making across the entire lifecycle.

Here are the key capabilities that can make or break capital project execution:

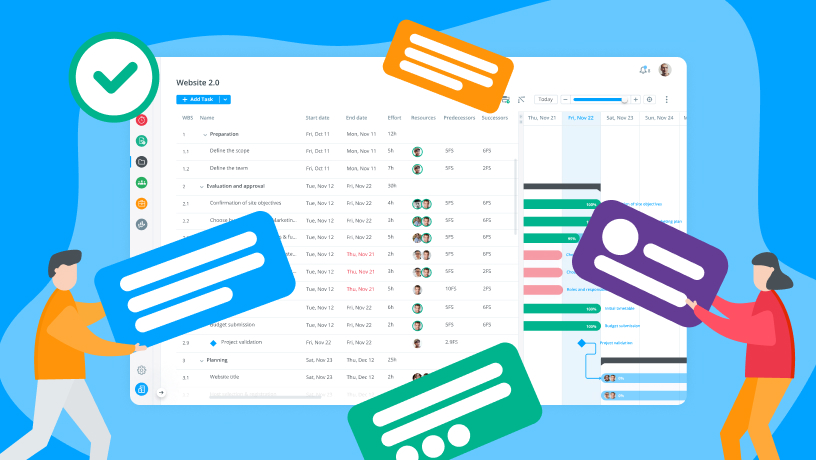

1. Gantt Charts for Capital Project Scheduling

Clear scheduling is essential for long-term initiatives with interdependent tasks. Gantt charts help teams visualize timelines, identify critical paths, and adjust in real time when delays occur. This visibility is especially important for coordinating internal departments and external contractors.

![]()

2. Budget and Cost Tracking

Capital projects involve complex financial structures from initial forecasts to phased spending and contingency buffers. Tools that track budgets against actuals and integrate with cost codes or ERP systems help ensure financial control and accountability throughout the project.

3. Project Templates and Workflow Automation

Standardizing capital project workflows with templates ensures consistency across similar initiatives (e.g. plant expansions, machinery rollouts). Automated workflows can streamline approvals, flag exceptions, and reduce the time needed for routine administrative tasks.

4. Centralized Document Management

Permits, contracts, drawings, specifications, compliance records… Capital projects generate substantial documentation. A centralized document management system ensures that teams always have access to the latest version, with audit trails and permission controls to support regulatory compliance.

5. Portfolio-Level Oversight in Capital Project Management

Capital initiatives rarely exist in isolation. Similarly, portfolio-level tools allow manufacturers to evaluate, prioritize, and monitor all active and planned capital projects against strategic objectives, capacity, and risk. This broader view is critical for resource optimization and long-term investment planning.

A McKinsey report notes that “companies using digital project management tools to centralize planning and execution see up to 15% savings in CAPEX and reduced rework across complex project portfolios.” (4)

Solutions like Cerri Project provide built-in capabilities for Gantt planning, document management, budget tracking, and portfolio governance – allowing manufacturers to manage complexity while maintaining strategic clarity.

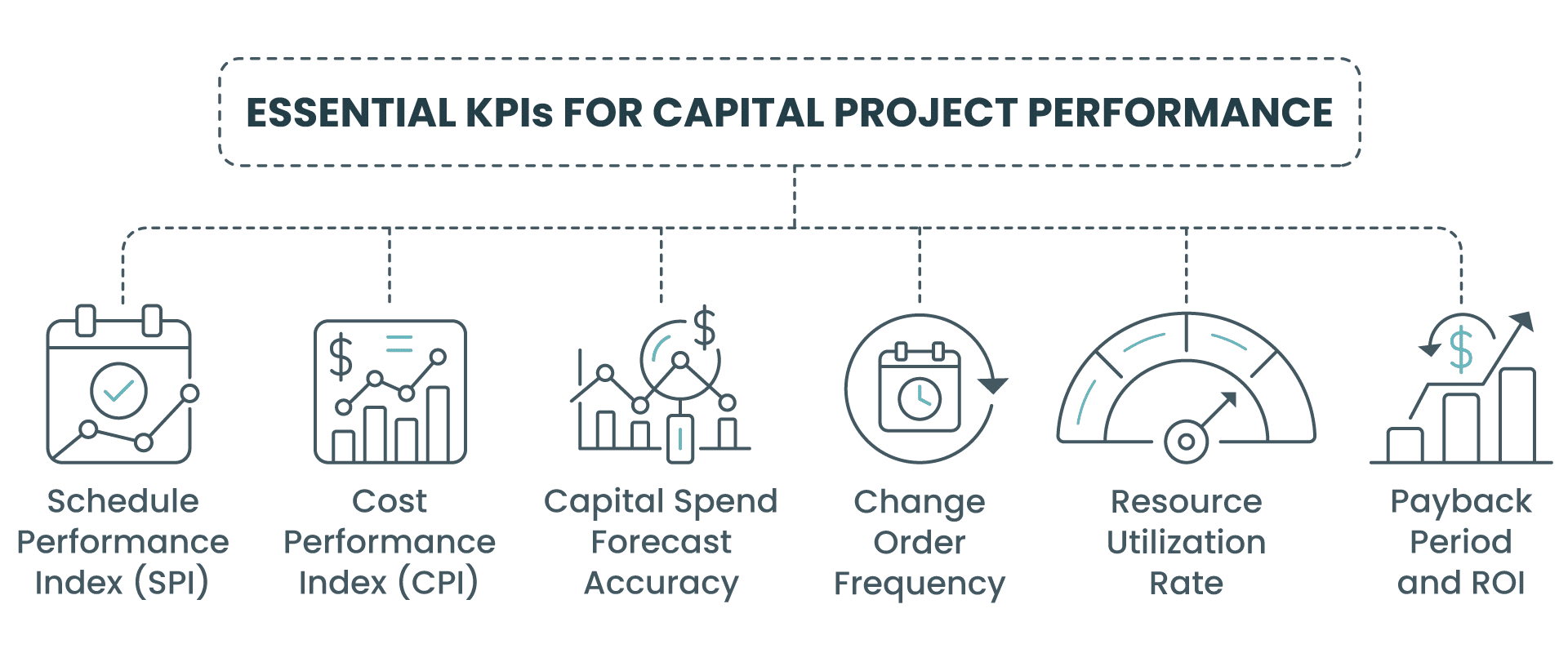

4. Essential KPIs for Capital Project Management

Tracking the right key performance indicators (KPIs) is essential to managing capital projects effectively – especially when decisions need to be made across long timelines, evolving scopes, and multiple stakeholders. KPIs provide the objective data needed to evaluate progress, manage costs, and anticipate risks before they escalate.

Here are the most relevant KPIs for manufacturing capital projects:

1. Schedule Performance Index (SPI)

Measures how efficiently the project is progressing compared to the planned schedule.

Formula: SPI = Earned Value (EV) ÷ Planned Value (PV)

Goal: SPI > 1 indicates the project is ahead of schedule.

2. Cost Performance Index (CPI)

Indicates cost efficiency relative to the value of work performed.

Formula: CPI = Earned Value (EV) ÷ Actual Cost (AC)

Goal: CPI > 1 means the project is under budget.

3. Capital Spend Forecast Accuracy

Assesses how close actual spend is to the original forecast. It’s critical in large CAPEX investments to manage cash flow, financing, and ROI expectations.

4. Change Order Frequency

Tracks how often change orders are submitted. In particular, a high frequency can signal inadequate planning or scope creep and should trigger reviews.

5. Resource Utilization Rate

Monitors the actual use of labor, equipment, or subcontractors against planned availability. Underutilization may indicate delays or misalignment, while overutilization can signal risk of burnout or inefficiency.

5. Payback Period and ROI

Finally, once the project is completed, measuring the actual return on investment and the time to recover initial capital expenditure ensures that the project delivered on its business case.

According to the Association for Project Management (APM), “robust performance measurement systems using KPIs such as SPI and CPI improve visibility and enable more proactive decision-making, especially in long-cycle capital programs.” (5)

To streamline KPI tracking, many project portfolio management tools (such as Cerri Project) offer dashboards with real-time data and automated reporting. As a result, executives and project leads can monitor performance across multiple projects and adjust course quickly when needed.

5. Governance and Risk Management in Capital Projects

Effective governance is the backbone of successful capital project management in manufacturing. It ensures that projects not only stay on track and within budget, but also comply with internal standards, regulatory frameworks, and strategic priorities.

Otherwise, even well-funded capital projects are vulnerable to inefficiencies, miscommunication, and compliance failures.

Project Governance: Building a Decision-Making Framework

Governance in capital projects involves a clear structure for how decisions are made, by whom, and when. This typically includes:

- Defined stage-gate or phase-gate reviews

- Formalized approval workflows

- Assigned project sponsors and accountable executives

- Centralized visibility for key stakeholders

As a result, these mechanisms ensure that each major project milestone is evaluated against performance, budget, and business value before advancing to the next phase.

PMI notes that “organizations with clearly defined governance structures see higher rates of project success and reduced risk exposure, especially in large-scale, capital-intensive projects.” (2)

Risk Management: From Assumptions to Action

Manufacturers face a wide range of risks in capital projects from delays due to supply chain disruptions, to scope changes, safety concerns, or cost volatility.

Best practices in risk management include:

- Maintaining a living risk register

- Assigning ownership to each identified risk

- Planning proactive mitigation and response strategies

- Conducting regular risk reviews throughout the project lifecycle

In regulated industries like pharmaceuticals, food & beverage, or energy, risk and compliance also include adhering to ISO, FDA, or environmental standards. In these cases, audit trails, documentation controls, and user permissions become critical parts of the governance toolkit.

6. Final Tips for Success in Manufacturing Capital Project Management

Even with the right tools and KPIs in place, capital projects in manufacturing require disciplined execution and clear alignment across teams. These final recommendations can help manufacturing organizations boost efficiency, reduce risk, and ensure long-term returns on their capital investments.

Standardize Intake and Prioritization

Standardize Intake and Prioritization

Before execution begins, formalize how projects are proposed, reviewed, and approved. As a result, a consistent intake process helps ensure that only strategically aligned and fully scoped initiatives move forward – saving time and minimizing rework later.

Build Contingency into Budgets and Schedules

Build Contingency into Budgets and Schedules

Unforeseen challenges are inevitable in long-term projects. Allocate contingency reserves for both time and cost to absorb variability without destabilizing the broader portfolio or causing cascading delays.

Align Technical and Financial Stakeholders

Capital projects touch both engineering and finance. Make sure technical leads and financial controllers stay aligned on timelines, cash flow needs, and business case assumptions – especially in later phases when costs ramp up.

Reuse What Works

Whenever possible, use templates, historical data, and reusable planning components. This accelerates delivery, reduces planning errors, and encourages organizational learning across similar capital initiatives.

Invest in Integrated Tools

Disconnected systems are one of the main sources of delay and inefficiency. By using integrated project management platforms that consolidate planning, budgeting, documentation, and reporting, teams can reduce friction and increase visibility.

As noted by McKinsey, “organizations that integrate digital tools into capital project management workflows are better positioned to adapt in real time, reduce administrative burden, and maintain alignment from boardroom to job site.” (4)

Conclusion: Why Capital Project Management Structure Matters in Manufacturing

Capital projects in manufacturing carry weighty expectations—and for good reason. They represent long-term investments with strategic implications, technical complexity, and significant financial exposure.

The manufacturers who manage them successfully are those who combine strong governance with the right tools and metrics. From early-stage prioritization to earned value analysis and post-implementation ROI tracking, every decision should be informed by data and aligned with strategic goals.

By leveraging purpose-built project management platforms – like Cerri Project – organizations can bring structure to complexity, clarity to performance, and accountability to every stage of their capital project lifecycle.

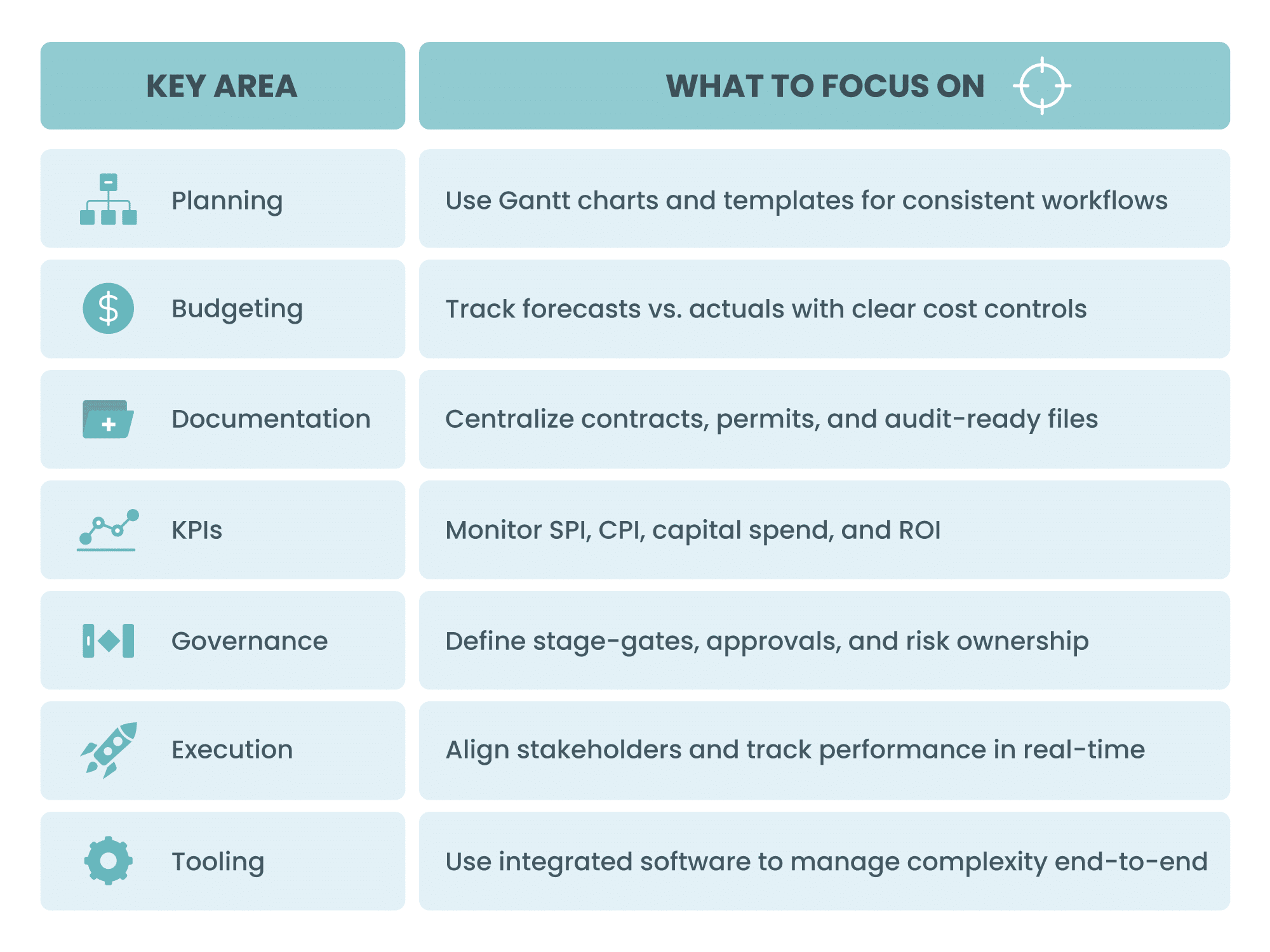

Summary: Capital Project Management Essentials

Sources & References

1 McKinsey & Company – Imagining construction’s digital future

https://www.mckinsey.com

2 Project Management Institute – Pulse of the Profession®: Next Practices in Project Governance

https://www.pmi.org/learning/library

3 PMI –The High Cost of Low Performance: Pulse of the Profession 2018 https://www.pmi.org/learning/library/high-cost-low-performance-11325

4 McKinsey & Company – How capital projects can be better run with digital integration

https://www.mckinsey.com/business-functions/operations/our-insights

5 Association for Project Management (APM) – Performance Measurement Guidance

https://www.apm.org.uk/resources

Task Management

Task Management

Customization

Customization